Integrated Sustainability Appraisal (ISA) Scoping Report

2. Economy and employment

2.1 This theme focuses on local businesses, access to employment, tourism, education, and skill level.

Policy context

2.2 Table 2.1 presents the most relevant documents identified in the policy review for the purposes of the RLDP and ISA.

Table 2.1 Plans, policies and strategies reviewed in relation to economy and employment

Document title

Year of publication

2015

Vale of Glamorgan STEAM Report

2021

2.3 The key messages emerging from the review are summarised below:

- The RLDP will be required to be in general conformity with Future Wales, which forms part of the development plan hierarchy and sets out the 20-year spatial framework for land use, providing a context for the provision of new infrastructure/ growth.

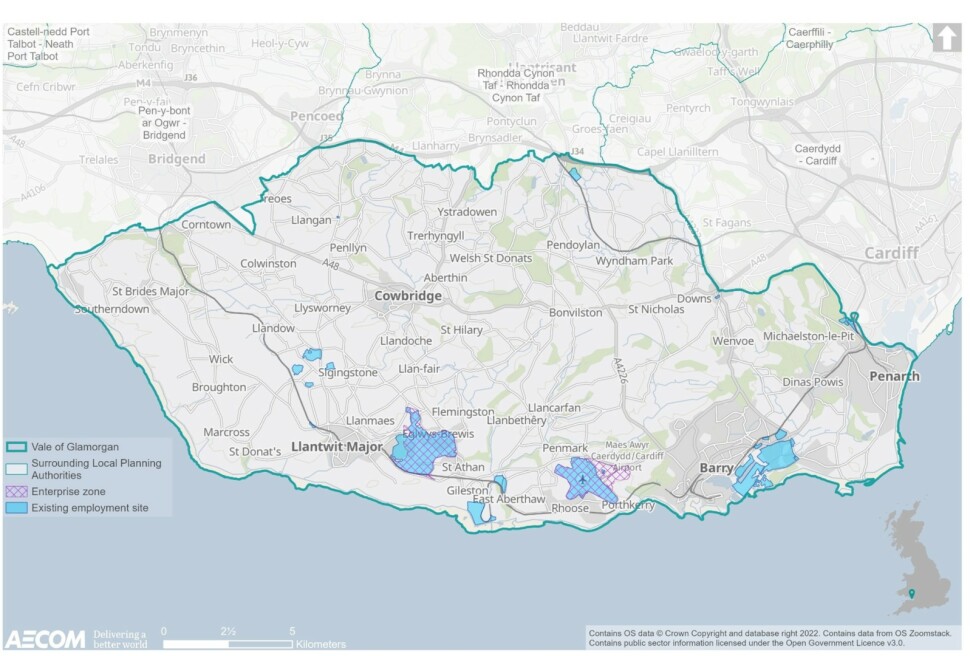

- Future Wales identifies 3 National Growth Areas within which the priorities for housing, economic development and investments are identified. These growth areas cover Wrexham and Deeside (North Wales), Swansea Bay and Llanelli (Mid and South West Wales) and Cardiff, Newport and the Valleys (South East Wales). Alongside these growth areas, Future Wales sets out national development policies for Wales as a whole.

- The Vale of Glamorgan falls within the South East Wales Growth Area (see Figure 2.1 below) where Cardiff, Newport, and the Valleys are identified as priority areas for growth. Within the wider growth area, the focus is on strategic economic and housing growth; essential services and facilities; advanced manufacturing; transport and digital infrastructure. Key investment decisions will seek to support places in the National Growth Area and the wider region. Policy 36 (South Wales Metro) states that SDPs and LDPs "should plan growth and regeneration to maximise the opportunities arising from better regional connectivity, including identifying opportunities for higher density, mixed use and car free development around new and improved metro stations."

Figure 2.1 Future Wales – South East Wales Region Strategic Diagram

- More specific to the Vale of Glamorgan is the existing and future role of the Cardiff Airport and Bro Tathan Enterprise Zone, and the Port of Barry which are set out within Future Wales: "Cardiff Airport is an essential part of Wales' strategic transport infrastructure. It is an international gateway connecting Wales to the world and is an important driver within the Welsh economy. Cardiff Airport is located within the Cardiff Airport and Bro Tathan Enterprise Zone which offers opportunities for investment in the site and surrounding areas. The Enterprise Zone offers a wide range of development sites and business accommodation, providing opportunities for the development of bespoke facilities or investment in existing accommodation" (page 82).

- "The region is served by ports at Newport, Cardiff and Barry. Each plays an important economic role and collectively they are key infrastructure within the region. Strategic and Local Development Plans should consider the role of the ports locally, regionally and nationally and establish frameworks to support their operation and potential expansion" (page 173).

- Future Wales highlights the importance of the region's connection with the Mid Wales and South West regions and the West of England region. Promoting accessibility and inter-linkages between these areas, based on an understanding of their roles and functions, will ensure these areas operate as a cohesive whole and do not compete against each other or take strategic decisions in isolation.

- National planning policy is set out in PPW, which predominately seeks to ensure planning decisions support economic and employment growth alongside social and environmental considerations within the context of sustainable development.

- PPW is supplemented by TANs and MTANs, which translate Welsh Government's commitment to sustainable development into the planning system, so that it can play an appropriate role in moving towards sustainability. The RLDP should aim to:

─ Co-ordinate development with infrastructure provision and support national, regional, and local economic policies and strategies.

─ Align jobs and services with housing, wherever possible, to reduce the need for travel, especially by car; and

─ Promote the re-use of previously developed vacant and underused land. - The Welsh Government Smarter working: a remote working strategy for Wales sets out its plans to work with businesses, trade unions and key stakeholders to help more employers adopt a more agile and flexible approach within their workplace. The strategy sets a target for 30 per cent of the Welsh workforce to be working at or near to home by 2026 and explains how the government plans to embed remote working for the long-term in the Welsh workplace. The strategy highlights the economic opportunities and benefits of home and distance working including increasing employment opportunities particularly in rural and semi-rural communities, providing employers access to a wider and more diverse workforce and the potential to increase productivity and reduce sickness absences.

- The Cardiff Capital Region and City Deal (CCRCD) seeks to promote strong, sustainable, and balanced growth throughout the region, 'Powering the Welsh Economy'. The deal aims to encourage investment and create an equal opportunity environment within the ten local authorities and other key partners in its boundaries. The RLDP should set out policies and proposals for the promotion of sustainable growth within the area for the benefit of its resident population.

- The CCRCD will help to boost economic growth by improving transport links, increasing skills, helping people into work, and giving businesses the support, they need to grow. It will also establish strong governance across the region.

- The overall aim of the 2018-20 Tourism Strategy is to identify strategic tourism objectives, and subsequently identify all actions in targeting those key objectives, to make significant improvements to the visitor experience in the Vale of Glamorgan. The Council adopted the Cardiff Airport & Gateway Development Zone Supplementary Planning Guidance (SPG) in 2019 which will guide future development on the site, in line with strategic tourism (and wider economic) objectives.

- In September 2020, the Council published its Coronavirus Recovery Strategy[4], which sets out the social, economic and well-being impacts that the pandemic has had on communities and setting out its key priorities and objectives. Of note to the RLDP and specifically this ISA theme, is the focus on green economic growth, employment, and infrastructure. This supports the Vale's Corporate Plan 2020-2025; notably objectives include supporting a 'well-educated and skilled population' and 'ensuring that individuals and communities are able to prosper and achieve their best'.

Baseline summary

Regional context

2.4 The South East region comprises Blaenau Gwent, Bridgend, Caerphilly, Cardiff, Merthyr Tydfil, Monmouthshire, Newport, Rhondda Cynon Taf, Torfaen and the Vale of Glamorgan and is the most populous region of Wales, with over 1.5 million residents. The region is the smallest of the four regions by area and includes the coastal cities of Cardiff and Newport and the former industrial heartlands of the South Wales valleys.[5] The Vale of Glamorgan is identified as being within the wider growth area for the region although Cardiff, Newport, and the Valleys are identified as priority areas for growth in Future Wales (Policy 1).

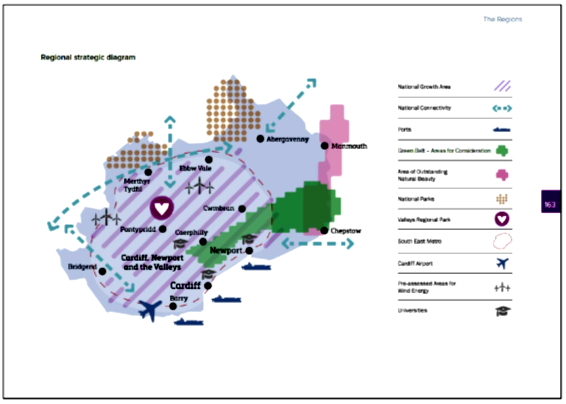

2.5 The Vale of Glamorgan is regarded as an affluent and attractive area to live and work. Benefiting from its proximity to Cardiff and the wider region, the area is home to 14,320 businesses and industries. The Vale also has good road and rail links to the rest of Wales and the UK, as shown in Figure 2.2 below, and discussed further in Chapter 7.[6]

2.6 The CCRCD is a £1.2 billion programme which was agreed in 2016 between the UK Government, the Welsh Government and the ten local authorities in South East Wales. Its aim is to bring about significant economic growth in the region through investment, upskilling and improved physical and digital connectivity.[7] Notably, the new Metro transport system will improve the way people travel around the Cardiff Capital Region. It seeks to provide faster, more frequent and joined-up services throughout the region, using trains, buses and light rail.

2.7 Analysis of the Cardiff Capital Region labour market taken from the Cardiff and Vale College Labour Market Intelligence report forecasts that the biggest growth in jobs will be in the Information and Communication industry, with a 25% growth in 2018, followed by Professional, Scientific and Technical Activities and Agriculture, Forestry and Fishing at 13% growth respectively.[8]

Figure 2.2 Vale of Glamorgan economic links[9]

Existing employment (enterprise zones)

2.8 Vale of Glamorgan has a significant employment offer, with 900ha of existing employment sites. The largest proportion of employees in the Vale of Glamorgan are employed in the Human Health and Social Work industry at 20% (8,000 jobs), this is followed by Wholesale and Retail Trade at 12% (5,000 jobs), and Education and Accommodation and Food Service activities at 10% (4,000 jobs) respectively.[10] The number of jobs available in the Vale of Glamorgan has remained largely consistent over the last 12 years.

2.9 Figure 2.3 below shows the location of existing employment sites in the Vale, specifically highlighting the Vale's 'Enterprise Zone'. The Cardiff Airport and Bro Tathan Enterprise Zone was designated by the Welsh Government in 2013. It comprises of three distinct zones: Cardiff Airport, Bro Tathan aerospace business park (East and West) and the Land to the south of Port Road known as the Gateway Development Zone. The enterprise zone seeks to build upon and extend the aerospace and maintenance sector that has developed in and around the airport and the MOD base at St Athan.

Bro Tathan Aerospace Business Park

2.10 The Bro Tathan Aerospace Business Park has the development potential for up to 3 million sq. ft of employment floor space. It has airside access to support a range of civilian or military uses including Maintenance Repair and Overhaul (MRO), manufacture, engine overhaul, Non-Destructive Testing (NDT) and Research and Development. The Aerospace Business Park is already home to major occupiers including Aston Martin Lagonda, eCube Solutions and Caerdav.

2.11 The Northern Access Road (NAR) has been completed and provides a high-quality direct access for new and existing businesses at the site. In addition, to support the continuing development at the Aerospace Business Park, the Welsh Government is currently preparing a development brief to guide development proposals at the Y Porth site.[11]

2.12 In terms of education opportunities, there are long established links with Welsh universities and world class aerospace training providers that operate adjacent to the airport at the International Centre for Aerospace Training (ICAT).

2.13 Notably, the Welsh Government are currently exploring alternative and complimentary activities in the wider aviation market of maintenance, repair and operations (MRO).

Cardiff Airport

2.14 Located within the Vale of Glamorgan, Cardiff Airport plays an important role both as an international gateway and as a major driver within the Welsh economy. Since its acquisition by the Welsh Government in 2013, the airport has increased its passenger numbers by over 65%.[12] However, 2020 has been particularly challenging for Cardiff Airport with two operators ceasing trading along with the implications of COVID 19 travel restrictions. Passenger numbers in 2020 were just under 220,000, a decrease of 87% on 2019.[13] The Civil Aviation Authority reported this to be the largest decline in any UK airport. Ambitious plans are underway to develop the airport over the next 20 years, with indicative masterplanning proposing a new terminal.[14] Further information related to Cardiff Airport is presented in Chapter 7.

2.15 The Council adopted the Cardiff Airport & Gateway Development Zone Supplementary Planning Guidance (SPG) in 2019 which will guide future development on the site.

Land south of Port Road (Gateway Development Zone)

2.16 This site is an employment and transport strategic site, with new transport infrastructure and employment opportunities identified, capitalising upon the Airport's strategic and regional importance in terms of attracting inward investment and creating jobs.

2.17 An outline planning application (2019/00871/OUT refers) in relation to the allocated employment land south of Port Road comprising 44.75 hectares of B1, B2 and B8 business park, associated car parking, drainage infrastructure, biodiversity provision and ancillary works together with a country park extension was quashed in the high court in October 2021. A resubmitted application is currently being considered by the council under the same application number.

2.18 There is currently a 'holding direction' from Welsh Government on Model Farm that prevents the Council from issuing a decision on the site. However, once the Council has finished its assessment process, the Government will make a decision whether or not to call the site in.

Existing employment (sites)

2.19 Table 2.2 below lists the existing employment sites within the Vale of Glamorgan, which can also be seen spatially on Figure 2.3 below. Outside of the enterprise zones, the Chemical Complex is the largest employment location (in terms of ha), followed by Barry Docks.

2.20 The Welsh Index of Multiple Deprivation (WIMD) Employment Domain illustrates that while employment opportunities are typically strong in the Vale of Glamorgan, there are some areas, most notably in the East of Barry where these employment opportunities are not as strong, or where people struggle to access these employment opportunities.[15]

Table 2.2 Vale of Glamorgan employment sites

Employment site

Size (ha)

MOD, St Athan

331.0

Cardiff Airport, Rhoose

209.9

The Chemical Complex, Barry

119.4

Barry Docks, Barry

76.2

Aberthaw Power Station, West Aberthaw

44.6

Vale Business Park, Llandow

23.6

Aberthaw Cement Works, East Aberthaw

16.5

Atlantic Trading Estate, Barry

14.8

Renishaw, Land South of Junction 34, M4

11.9

Llandow Trading Estate, Llandow

11.5

Ty-Verlon Industrial Estate, Barry

11.4

Dyffryn Business Park, Llandow

6.7

Llandough Trading Estate, Llandough (Penarth)

5.3

West Point Industrial Estate, Llandough (Penarth)

5.2

Llandow Trading Estate (South), Llandow

4.3

Cardiff Road Business Park, Barry

3.3

Sully Moors Industrial Estate, Barry

3.1

Palmerston Trading Estate, Barry

2.2

Vale Enterprise Centre, Barry

1.8

Heritage Business Park, Llantwit Major

1.7

St Hilary Business Park, Culverhouse Cross

1.2

Airport Business Park, Rhoose

1.1

West Winds Industrial Estate, Fferm Goch

0.5

Figure 2.3 Vale of Glamorgan employment sites and enterprise zones

Employment rates

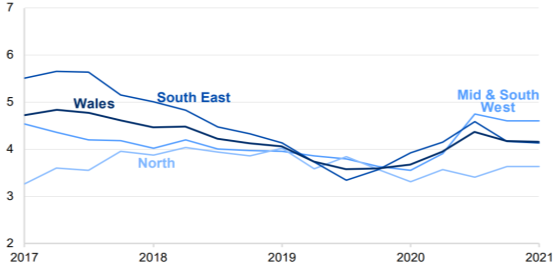

2.21 The headline Labour Market Overview (LMO) estimates are published by the Office for National Statistics (ONS). As shown in Figure 2.4 below, the latest LMO indicates that the employment rate in Wales was 74.1% of those aged 16-64 between January and March 2022. In comparison, the UK employment rate was 75.7% during the same period.

2.22 Figure 2.4 shows that employment rates in Wales have dropped since 2018, with a considerable decrease in 2020, which is likely to be a result of the coronavirus pandemic. However, figures for 2022 show an increase since 2020, which matches the general trend seen for the UK overall.

Figure 2.4 Employment Rate (percentage of population age 16-64)[16]

2.23 While the ONS data prepared by 'nomis' is not directly comparable with the LFS data above, the most recent nomis data for the Vale of Glamorgan (January 2020 – December 2020) shows a gradual decrease in employment rates. 77.6% (60,900) of the Vale of Glamorgan population are identified as being economically active, which is greater than the overall Wales figure of 75.7%.[17]

2.24 In terms of unemployment, Figure 2.5 below shows unemployment rate by economic region compared to the overall rate for Wales. Before the end of 2019, the unemployment rate remained consistently higher in South East Wales than the other regions. In 2021, the unemployment rate increased in all three economic regions in Wales compared with the previous year, although South East Wales had the smallest increase, up by 7.4%. Also in 2021, Mid and South West Wales had a higher unemployment rate than South East Wales, and North Wales maintains the lowest unemployment rate. The overall trend for Wales and the three economic regions is a decrease in unemployment over the past four years.

Figure 2.5 Unemployment rate by economic region (percentage of economically inactive population)[18]

2.25 As with employment rates, the percentage of the economically inactive people within the Vale of Glamorgan mirrors the declining national picture. Nomis data indicates that in March 2021 5.4%, (4,310 people) in the Vale of Glamorgan were unemployed, compared to the Welsh average of 5.9% and the UK average of 6.5%.[19]

2.26 The percentage of people who are self-employed in the Vale of Glamorgan has fluctuated over the last 15 years, with considerable falls following the recession starting in 2007. In December 2020, the percentage of people who were self-employed in the Vale of Glamorgan was 8.4%, below both the Welsh average of 9.3% and the Great Britain average of 9.9%.[20]

Covid-19

2.27 The Wales Centre for Public Policy estimate that 42% of the UK's economy has been impacted by the Covid-19 pandemic. While the economic impact of the pandemic has hit people across the UK there are indications that the labour market shocks associated with the pandemic have been felt more by young people and the lowest paid. Five LSOAs in the Vale of Glamorgan are ranked in the top10% most deprived (a rank of 191 or below) LSOAs in Wales according to the Income Domain; all are in Barry.[21] Deprivation levels throughout the Vale are discussed further in Chapter 5.

2.28 During the pandemic, within three months the employment rate in the Vale of Glamorgan fell by 1.8% (March 2020 from December 2019). Although all industry sectors have been affected by the pandemic, the Service Sector, in particular 'customer facing' services such as Accommodation and Food Services activities, have been particularly affected.[22]

2.29 StatsWales have indicated a large increase in the benefit claimant count rate in Wales since February 2020. Whilst not everyone claiming these benefits will be unemployed, there was an 87.7% increase of people claiming Universal Credit in early March 2021 compared to February 2020.[23]

Broadband

2.30 As evidenced by the pandemic, availability and access to good internet coverage has become increasingly important to our daily lives. The take up of high-speed broadband infrastructure in Vale of Glamorgan is the highest in Wales.[24]

2.31 At the height of the pandemic, it was estimated that as many as 40% of people were working from home.[25] Data from WIMD 2019 provides an insight into the quality of broadband availability across the Vale of Glamorgan. LSOAs in towns such as Barry, Penarth and Cowbridge show high availability of broadband at 30mbs and LSOAs in more rural areas show poorer availability. It is estimated that 27% of homes in Rhoose, 3 in the Western Vale cannot receive broadband at 30 mb, while it is estimated that 25% of homes in Sully, 2 in the Eastern Vale cannot access broadband at these speeds. The Vale of Glamorgan council is working with the Welsh Government through the 'local broadband fund' to improve internet access in some areas where infrastructure is more difficult to establish.

Education

2.32 The Vale offers access to a range of education facilities, reflecting the diverse nature of the authority. Larger dual-entry Primary schools are seen in more urban areas while relatively small schools are often located in more rural areas (see Figure 2.6). Secondary schools are predominately located in major towns, while one Welsh medium middle school (ages 3-19) is in Barry. There is one Local Authority maintained Special School which is in Penarth.

2.33 There are three independent schools located in the Vale of Glamorgan, including the United World College of the Atlantic (Atlantic College) located in St Donats. There is one further education institution, Cardiff and Vale College in the county, with campuses located in Barry and the Cardiff Airport and Bro Tathan Enterprise Zone.

2.34 The location of schools in and near the Vale are shown below in Figure 2.6. Schools are focussed near the Vale's urban centres, with less provision in rural areas. Vale of Glamorgan residents also have reasonable access to schools in neighbouring local authority areas. Figure 2.6 shows an abundance of schools in Bridgend to the west of the Vale, and Cardiff to the east. Comparatively, there are relatively few schools in Rhondda Cynon Taf to the north.

2.35 Specifically, within the Vale, school provision includes:

- Two Local Authority maintained Nursery Schools.

- 44 Local Authority maintained Primary Schools (38 English Medium / 6 Welsh Medium).

- One Local Authority maintained Welsh Medium middle school (ages 3 to 19).

- Seven Local Authority maintained Secondary Schools; and

- One Local Authority maintained Special School.

Figure 2.6 Schools within and adjoining Vale of Glamorgan

School Type

Location

Primary

Barry

Colwinston

Cowbridge

Dinas Powys

Fferm Goch (Llangan Primary School)

Llandough (Penarth)

Llantwit Major

Penarth

Peterston Super Ely

Pendoylan

Rhoose

St Athan

St Brides Major

St Donats

St Nicholas

Sully

The Herberts (Llanfair Primary School)

Wenvoe

Wick

Secondary

Barry

Cowbridge

Llantwit Major

Penarth

Roman Catholic Primary

Barry

Roman Catholic Secondary Barry

Barry

Nursery

Penarth

2.36 In terms of further education, several institutions are within one hour drive time of the Vale as follows:

- Universities:

─ Cardiff University.

─ Cardiff Metropolitan University.

─ Swansea University; and

─ University of South Wales. - Colleges

─ Bridgend College.

─ Cardiff & Vale College.

─ Coleg Y Cymoedd.

─ Gower College Swansea.

─ Neath Port Talbot College; and

─ UWC Atlantic College, St Donats.

2.37 Relevant headline findings in the Vale of Glamorgan Well-being Assessment (2021) include:

- The Vale of Glamorgan has one of the highest levels of people qualified to NVQ level 4 and above in Wales; although differences exist across the Vale of Glamorgan with LSOAs in Barry recording a higher proportion of people aged 16-64 with no qualifications than LSOAs in the Eastern and Western Vale.

- Across all years of apprenticeships started, the majority of apprenticeships have been in the Health Care and Public Services Sector, with Health and Social Care and Management and Professional the next largest sectors.

- There is an evident split in apprenticeships started by gender and sector. Females make-up the majority of Healthcare and Public Services and Health and Social Care Apprenticeships started in the Vale of Glamorgan. For males, the sectors with the largest number of apprenticeships started are Engineering, Construction, Management and Professional and Management sectors.

- 17% of employers in South East Wales either had apprenticeships or currently offered apprenticeships. Of these employers offering apprenticeships, 72% that had recruited people specifically as apprentices in the last three years had retained at least one of their apprentices after their apprenticeship had finished.

Retail

2.38 The national retail sector continues to experience difficult times. Many well-known high street retailers have gone into administration and many others have scaled back their presence on the high street and changed their emphasis to favour digital sales platforms. Subsequently, there has been a continued decrease in retail floorspace within the authority's town and district centres which represents a 5.05% reduction since 2017.

2.39 Table 2.3 below shows the general trend seen of increasing vacancy rates, particularly in the Vale's town centres. Notably, vacancy rates within Barry and Llantwit Major have dropped since 2011, while rates within Penarth and Cowbridge have increased. Table 2.3 shows the highest average vacancy rate for the Vale of Glamorgan was recorded last in 2020. The survey for this period was undertaken in August 2020 during Covid-19 lockdown restrictions which had a detrimental impact upon the vibrancy, vitality and attractiveness of retail centres. However, in the most recent retail survey undertaken in June 2021 vacancy rates in all centres have dropped from the previous year reducing the average vacancy rate to 6.96%.

2.40 Vacancy rates overall for the Vale have decreased slightly since 2011, while overall vacancy rates in Wales and the UK have increased.

2.41 Table 2.3 further shows that the vacancy rate for the UK had risen to 14.1% in 2021, whilst the vacancy rate for Wales is 19.2% (1 in every 7 shops is vacant in Wales). Comparatively, the Vale of Glamorgan vacancy data shows the retail centres within the Vale of Glamorgan have begun to recover from the impact of lockdown restrictions in Wales.

2.42 However, there have been rises in other commercial floorspace such as leisure and office floorspace, demonstrating that town and district retail centres are diversifying from the traditional A1 retail uses in part as a response to changing shopping habits. This is also reflective of the changes made to national planning policy which also promote retail and commercial centres as hubs for social and economic activity and the focal point for a diverse range of services which support the needs of local communities.

Table 2.3 Vacancy rates in the Vale of Glamorgan[26]

|

Year |

Average vacancy rates |

|||||||

|

High Street, Barry |

Holton Road, Barry |

Cowbridge Town centre |

Llantwit Major Town centre |

Penarth Town centre |

VOG Town Centres |

Wales |

UK |

|

|

2012 |

12.3% |

15.8% |

3% |

5% |

1% |

7.4% |

18% |

14.6% |

|

2013 |

17.5% |

8.7% |

2.8% |

4.9% |

1.6% |

7.1.% |

17% |

11.9% |

|

2014 |

10.3% |

12.5% |

8.3% |

9.2% |

5.8% |

9.2% |

17.9% |

10.3% |

|

2015 |

10.9% |

7.6% |

7.8% |

3.9% |

5.3% |

7.1% |

15.5% |

13.3% |

|

2016 |

9.7% |

8% |

10.8% |

5.8% |

3.5% |

7.6% |

12.1% |

9.5% |

|

2017 |

8.8% |

14% |

8.3% |

9% |

4% |

8.8% |

12.5% |

9.4% |

|

2018 |

10.4% |

13.9% |

12.90% |

4% |

5.17% |

9.27% |

15.4% |

8.9% |

|

2019 |

4.8% |

17.65% |

11.96% |

7.92% |

5.14% |

9.49% |

13.4% |

10.3% |

|

2020 |

7.3% |

16.04% |

17.3% |

3.96% |

3.43% |

9.61% |

15.9% |

12.2% |

|

2021 |

4% |

13.98% |

11.6% |

2.97% |

2.25% |

6.96% |

19.2% |

14.1% |

Tourism

2.43 Located within the most populated area of Wales and in close proximity to Cardiff, the Vale of Glamorgan is well situated in terms of its catchment area for both day visitors and also as a base for visitors wishing to explore South Wales.

2.44 The Vale has a range of attractions for tourists that utilise the natural environment to improve the area's economic well-being. This includes the Glamorgan Heritage Coast, the Wales Coast Path and well-established seaside resorts; attractive countryside and country parks; unique historic features; several outdoor pursuit activities; and a well-established network of walking routes.

2.45 Barry Island seafront and Whitmore Bay are recognised as one of the main tourist destinations within the Vale of Glamorgan. The resort is well known throughout the South Wales Valleys, South West England and the West Midlands from which historically a high proportion of visitors were drawn. The resort's main attractions include the beach, Barry Island Pleasure Park, other smaller attractions and numerous amusements, cafes and bars. Despite having to face major market changes and ever increasing demands the area still attracts an estimated 424,000 visitors with and economic value of £17.m[27]

2.46 The economic contribution of the tourism sector has been growing year on year in Vale of Glamorgan; however, in 2020 data suggests the economic impact of the sector had fallen by 45.1% (see Table 2.4). This has coincided with a 45.3% fall in the number of full-time equivalent jobs employed in the sector. It also shows the total day visitors saw a decrease of 68% from 2019 to 2020 (an approximate loss of 1.89 million visitors).[28] This widespread significant negative trend seen in 2020 from 2019 is accredited to the coronavirus pandemic and subsequent closure of businesses and intermittent lockdowns.[29]

2.47 As shown in Table 2.4, for all indicators, data for 2020 does not reflect trends from previous years, which showed a continual increase in visitor numbers, visitor days, employment and overall economic impact from 2013 – 2019. It is considered that as the Vale recovers from the pandemic, trends will increase to meet and exceed growth seen pre-pandemic.

Table 2.4 Vale of Glamorgan tourism indicators (percentage change 2009 to 2020) [30]

| % Change from 2009 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Economic Impact - Historic Prices | 6.7% | 0.0% | 1.1% | 15.6% | 22.4% | 29.6% | 30.7% | 42.1% | 52.2% | 62.2% | -45.1% | |

| Visitor Numbers | 2.3% | -13.0% | -15.1% | -2.6% | -0.3% | 5.3% | 5.5% | 10.8% | 13.6% | 15.1% | -63.5% | |

| Visitor Days | 2.1% | -9.2% | -10.6% | -1.3% | 0.8% | 5.8% | 5.8% | 10.9% | 13.7% | 15.8% | -63.0% | |

| Total Employment | 2.3% | -8.6% | -8.8% | -0.7% | -5.8% | -0.4% | -0.4% | 2.2% | 2.3% | 7.9% | -45.3% |

Regeneration of Barry

2.48 The town of Barry continues to be transformed through major regeneration projects in partnership with the Vale of Glamorgan Council. Historic landmark buildings are being brought back into successful commercial use, alongside new investment in the seafront and waterfront areas of the town.[31]

2.49 The comprehensive regeneration of the 100-acre waterfront site has delivered a new road link to Barry Island, connecting this tourism hotspot with the development. The regeneration of the Waterfront has so far seen the development of around 1600 new homes alongside private investment in a new hotel, retail leisure and commercial ventures.[32] Agriculture

2.50 The Agricultural and Food sector is not only important economically in Wales, but also culturally; this is especially true in the Vale of Glamorgan. It is anticipated that sheep farming, which along with cattle farming is the dominant farming type in the Vale of Glamorgan, may become less economically viable due to the changes in market access and public funding restrictions.[33]

2.51 As of 2019, 700 people in the Vale of Glamorgan were employed in the agriculture, forestry and fishing sector. This only represents 1.6% of the working population (42,800 people)[34].

Future baseline

2.52 Certain sectors are more susceptible to the effects of unemployment in the Vale, including the manufacturing and service sectors. Overall predictions for 2040 indicate that employment rates in the authority will drop by approximately 6%. This has the potential to be exacerbated by infrastructure that is poorly connected to key service centres and fails to offer increased opportunities for employment overall.

2.53 While the number of jobs available in the Vale of Glamorgan has remained largely consistent over the last decade, the Covid-19 pandemic has had an impact on the need for employment land and premises. Town and district retail centres are diversifying from the traditional A1 retail uses in part as a response to changing shopping habits. This is reflective of the changes made to national planning policy which also promote retail and commercial centres as hubs for social and economic activity and the focal point for a diverse range of services which support the needs of local communities. The increase in non-retail uses in all retail centres reflects their changing role nationally and is likely to be an ongoing trend.

2.54 The Welsh Government's commitment for encouraging home and distance working to continue post pandemic provides opportunities for employment within rural and semi rural locations and potential increased demand for flexible work spaces within urban settlements.

2.55 Strategically, Cardiff Airport and Bro Tathan Enterprise Zone will assist in the delivery of significant aviation related economic growth not only in the Vale of Glamorgan but also in the wider Cardiff Capital Region. The City Deal presents significant opportunities to improve economic well-being across the region. The South Wales Metro development (discussed in Chapter 6) specifically has the potential to bring widespread changes to the local and regional economy that could be realised over a relatively short timeframe. The region's assets are its connections with the Mid Wales and South West Wales regions and the West of England region.

Key issues

2.56 The context review and baseline information informed the identification of several key issues (problems and opportunities):

- The Vale's location within the Cardiff Capital City Region gives it access to an investment programme of £1.2 billion, including the delivery of the South Wales Metro which will improve connectivity throughout the region.

- The Vale of Glamorgan is identified within Southeast Wales Growth Area, future growth shall need to consider how the needs of the community are aligned with sustainable development and climate change objectives.

- The employment rate in the Vale of Glamorgan has been consistently above that of the Welsh employment rate, and broadly in-line with the GB employment rate. However, high levels of unemployment exist in the county borough, in addition to low levels of income and educational deprivation, notably in certain areas within Barry.

- Cardiff Airport and Bro Tathan Enterprise Zone include 550 ha of employment space. Future development/ expansion of these areas will deliver significant aviation related economic growth throughout the region, support high quality jobs and training/ education for Vale residents.

- Agile working patterns catalysed by digitalisation and the impacts of the COVID-19 pandemic will need to be reflected in local planning policy.

- Continued rise in leisure and office floorspace, with town and district retail centres diversifying from the traditional A1 retail uses in part as a response to changing shopping habits. The RLDP will need to consider how policy can accommodate trends in shopping habits and the changing nature of retail and the evolving role of our town, district and local centres.

- Access to broadband varies throughout the Vale; however, it is noted that the Council is working with Welsh Government through the 'local broadband fund' to improve internet access in areas where infrastructure is more difficult to establish. This will be important if the Vale of Glamorgan wishes to capitalise on the economic opportunities created through home and distance working.

- The Vale has a range of attractions for tourists that utilise the natural environment to improve the area's economic well-being. It will be important for the Vale to utilise its assets in a sustainable way to ensure future social, economic, environmental and cultural well-being throughout communities is enhanced and the integrity of the assets maintained and improved.

ISA objectives

2.57 Considering the key issues discussed above, it is proposed that the ISA should include the following objective and assessment questions:

ISA objectives

Assessment questions – will the option/proposal help to:

Support a sustainable, diverse, and resilient economy, with innovative responses to changing conditions and support for a strong future workforce.

- Provide sufficient land for businesses to grow and ensure alignment with housing/infrastructure?

- Support the creation of accessible new jobs and facilitate home and distance working?

- Support the Cardiff Airport and Bro Tathan Enterprise Zone, reflecting its regional importance in terms of attracting inward investment?

- Ensure that town centres are considered first for new commercial, retail, education, health, leisure and public service facilities?

- Ensure the capacity of educational facilities keep pace with population growth?

- Enhance the vitality and resilience of town centre and retail centres, supporting diversification in line with changing needs?

- Safeguard existing employment areas?

- Create an attractive tourism destination?

- Encourage sustainable development and quality facilities to enrich the experience for visitors and residents?

- Promote a green economy and decarbonisation?

- Ensure the economy grows in a sustainable manner?

- Promote a prosperous Wales?

[4] Vale of Glamorgan Council (2020): 'Coronavirus Recovery Strategy', [online] available to access via this link

[5] Welsh Government (2021): 'Update to Future Wales: The National Plan 2040', [online] available to access via this link

[6] Vale of Glamorgan Council (2020): 'Invest in the Vale of Glamorgan'

[7] Office for the Secretary of State for Wales (2016)L 'City Deal: Cardiff Capital Region', [online] available to access via this link

[8] Vale of Glamorgan PSB (2021): 'Wellbeing Assessment 2021 – Education and Employment'

[9] Vale of Glamorgan Council (2020): 'Invest in the Vale of Glamorgan'

[10] Vale of Glamorgan Council (2021): 'Local Development Plan 2011-2026 3rd Annual Monitoring Report'

[11] Welsh Government (2020): 'Bro Tathan Development Brief', [online] available to access via this link

[12] Vale of Glamorgan Council (2021): 'Local Development Plan 2011-2026 3rd Annual Monitoring Report'

[13] Ibid.

[14] Cardiff Airport (2021): 'Our Airport Masterplan 2040', [online] available to access via this link

[15] Vale of Glamorgan County Borough (2021): 'Local Development Plan 2011-2026 3rd Annual Monitoring Report'

[16] Welsh Government (2022): 'Labour market overview: May 2022', [online] available to access via this link

[17] Vale of Glamorgan County Borough (2021) Local Development Plan 2011-2026 3rd Annual Monitoring Report

[18] Welsh Government (2022): 'Labour market overview: May 2022', [online] available to access via this link

[19] Ibid.

[20] Ibid.

[21] Vale of Glamorgan PSB (2021) p18, Assessment 2021 – Education and Employment

[22] Ibid.

[23] Vale of Glamorgan County Borough Council (2021) Local Development Plan 2011-2026 3rd Annual Monitoring Report

[24] Vale of Glamorgan County Borough Council (2021) Local Development Plan 2011-2026 3rd Annual Monitoring Report

[25] Ibid.

[26] Vale of Glamorgan retail monitoring data 2011 - 2021

[27] STEAM (2019)

[28] Cathy James (2021) Global Tourism Solutions (UK) Ltd STEAM trends Vale of Glamorgan

[29] Cathy James (2021) Global Tourism Solutions (UK) Ltd STEAM trends Vale of Glamorgan

[30] Cathy James (2021): 'Global Tourism Solutions (UK) Ltd STEAM trends Vale of Glamorgan'

[31] Vale of Glamorgan Council (2020): 'Invest in the Vale of Glamorgan'

[32] Ibid.

[33] Vale of Glamorgan PSB (2021): 'Wellbeing Assessment 2021 – Education and Employment'

[34] Welsh Government (2019): 'Workplace employment by Welsh local areas and broad industry', [online] available to access via this link